Seeing Our Customers Home Again

The Light is what guides you Home.

The warmth is what keeps you there.

Our new Home Again program is a great option

to help borrowers

who may have a

few bumps and bruises on their credit.

Highlights

•Fixed and ARM (Adjustable Rate Mortgage) options

•No prepayment penalty

•Gifts allowed from family members or

relative only toward

down payment or closing

(Borrowers must have 5% of purchase price.

Program available for purchase only.)

•Gift of equity from seller

•85% LTV (first time home buyers eligible)

•12 month seasoning period required

after major derogatory event

(e.g., bankruptcy, foreclosure, deed in lieu of foreclosure or short sale)

•Primary residence only

Call for Jumbo terms

Call today for additional information about this great new program.

We offer complimentary mortgage reviews and preapprovals!

C G Barbeau

Caroline Gerardo

NMLS: 324982, CA #CA-DBO324982

Senior

Loan Officer

Eagle Home Mortgage

Office: 949-784-9699 Fax: 855-833-4303

Contact Me

My Website http://eaglehomemortgage.com/carolinegerardo/

Universal American Mortgage Company of California, dba Eagle Home Mortgage of California. Licensed by the Department of Business Oversight under the California Residential Mortgage Lending Act. RMLA #4130383, NMLS #252392, Branch NMLS #849059, CA #813I609, NV #3244. Certain restrictions apply.

This is not a commitment to lend.

Applicants must qualify.

Equal Housing Lender

This message was sent from Caroline Gerardo to as a result of an existing business relationship.

It was sent from:

Eagle Home Mortgage, a Lennar Homes Company

100 Spectrum Center Drive Suite 500 Irvine CA 92618

11/09/2015

11/04/2015

Sleep Easy in Your Home

We close loans that banks won't touch

Sleep easy

Here's the tips and tricks for today' s mortgage loans

FANNIE’S AGENCY CONFORMING

PROGRAM

v There are no minimum number of

trade lines required with DU approval.

v Ratios are per DU

v

You

can pay off debt to qualify and do not need to close the account to

exclude payment from debt to income ratio

v One time thirty day mortgage late is allowed with letter of explanation from borrower

v

Fannie

will accept a “Legal Separation Agreement” in lieu of a final Divorce Decree

v

Flips

(less than 90 days) allowed if Field Review supports appraised value

v

When

purchasing a investment property use the market rent from the 1007 for rental income;

no other documentation is required

v

Seller

carry back is allowed

v

A two year land lord history is not required but if the borrower does not have a

history of receiving rental income they must have a current mortgage history.

v

Fannie

no longer requires there to be 30% equity in the home when converting a primary

residence to non owner occupied and using rental income towards qualifying

** Most major banking

lenders will still have many overlays in place excluding borrowers from these

loan programs. I can close home loans that Wells Fargo, Chase and other banks deny.

Banks turn down residential mortgages that we close.

I

have an new deal from Bank of America due to not having 2 years landlord history!

11/03/2015

Thinking Out of the Box

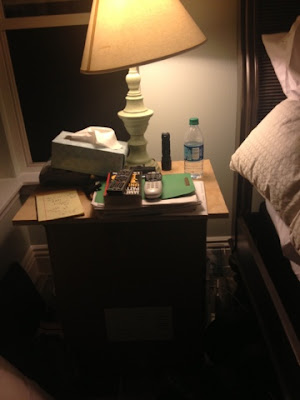

Cardboard Box house

A bitter sweet story.

My sister and her family had a flood. They live in Orange County in a home that is worth a million dollars. Actually it was worse than a flood the tankless water heater continued to spray boiling water in her home through a faulty Home Depot made in China plumbing part. She was on vacation and we were watching her pets. Daughter went to the house and initially thought smoke was coming out of the seams of the windows, but it was steam...

Total loss of contents. It's been months rebuilding. They lost an antique bedroom set that I gave her. The set was gorgeous oak made in 1880 and destroyed like most of her house.

My brother in law is a fireman, well retired fire fighter, a real good guy. Sister who is a first grade teacher has been having melt downs because they are in the house with everything a mess. Here's what her hubby build for temporary to keep her organized-

Cardboard box dresser, cardboard box night stands, and yes even vanity.

I am sharing with you a spirit of overcoming adversity with humor and creativity.

Keep your eye on simple solutions and re-use what's at hand.

We pray the insurance company treats them fairly.

My sister and her family had a flood. They live in Orange County in a home that is worth a million dollars. Actually it was worse than a flood the tankless water heater continued to spray boiling water in her home through a faulty Home Depot made in China plumbing part. She was on vacation and we were watching her pets. Daughter went to the house and initially thought smoke was coming out of the seams of the windows, but it was steam...

Total loss of contents. It's been months rebuilding. They lost an antique bedroom set that I gave her. The set was gorgeous oak made in 1880 and destroyed like most of her house.

My brother in law is a fireman, well retired fire fighter, a real good guy. Sister who is a first grade teacher has been having melt downs because they are in the house with everything a mess. Here's what her hubby build for temporary to keep her organized-

Cardboard box dresser, cardboard box night stands, and yes even vanity.

I am sharing with you a spirit of overcoming adversity with humor and creativity.

Keep your eye on simple solutions and re-use what's at hand.

We pray the insurance company treats them fairly.

11/02/2015

Bad News For HERO and PACE Programs

HERO PACE PROGRAMS IMPORTANT INFORMATION Energy Efficient Improvements What they failed to tell you...

First

and foremost, FNMA, FHLMC, nor FHA will not allow these programs to remain on

the title policy. Nor will they allow to subordinate. The subordination they provide does not clear title. These programs cloud title and act like property tax bills in first position

Property owners may not be aware they can't refinance or sell with this on title

Even for a refinance, borrower might not understand the contract with this program.

As

an example of how they appear on the preliminary title report:

Assessments and other matters for the

Western Riverside Council of Governments as contained

in a document entitled "Payment of

Contractual Assessment Required" and/or "Notice of

Assessment" (California Hero Program),

recorded March 11, 2014 , as Document No.

2014000089985

of Official Records.

The HERO and PACE programs were a great thing to reduce energy costs but they stick the property owner with a big mess When the HERO program shows on the

prelim it is recorded just as the County Tax Assessor as first in line. They are a cloud on the title.

HERO

– “Home Energy Renovation Opportunity” Also known as PACE “Property Assessed

Clean Energy”.

These

are programs offered by localities to finance residential energy improvements

with loans that are generally repaid through the homeowner’s real estate tax

bill.

Since

they are part of the property tax bill, they remain in first position. I

spoke to FNMA today about this program and HERO’s willingness to subordinate

the loan. FNMA said that their subordination agreement is a “limited”

subordination in that they are promising not to foreclosure, but since it is

included in the property taxes, they remain in first position and therefore

FNMA will not purchase mortgages with the HERO, or PACE (as they call

it). The borrower will need to do a cash out refinance And pay off the HERO.

Fannie Mae and Freddie Mac will NOT allow subordination agreements, they must be paid off in full to have clean title FNMA and FHLMC guides.

There is a provision for PACE loans taken out prior to 7/6/10. If you run

into one of these, I would contact Loan Support for guidance. There have

been several conversations with FHA as well and they will not accept.

They too would require a cash out refinance. And pay the debt off at closing the mortgage loan.

Those people who got these programs to insulate, add energy efficient windows or solar from "government" or "county" programs usually have no idea this is a problem.

My Eagle Home Mortgage Website

Books by C G

Those people who got these programs to insulate, add energy efficient windows or solar from "government" or "county" programs usually have no idea this is a problem.

My Eagle Home Mortgage Website

Books by C G

Subscribe to:

Posts (Atom)