| ||

| ||

| ||

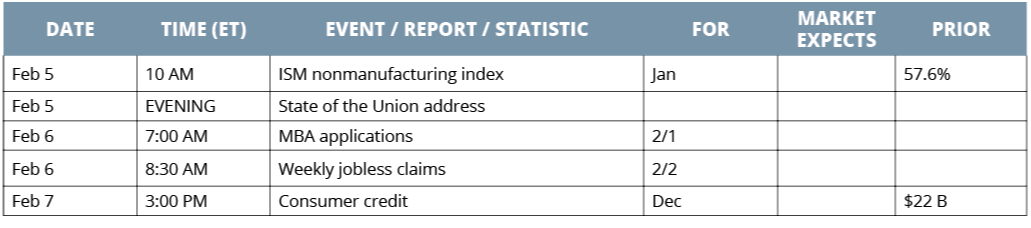

WEEK OF FEBRUARY 4, 2019

| ||

|

2/04/2019

Market News

1/22/2019

Get Your Offer Accepted

Why was your offer rejected?

Low ball price

Too long of escrow time frame

Unflexible on closing time frame

Unwilling to release contingencies

Contingent sale of another house

Unknown lender

Unknown Realtor

Unpleasant parties of any sort

You reveal you are an attorney

You reveal negative information

How to fix this:

Have a printed pdf copy of your Pre- approval with few or no conditions with fast close

time frame written as guarantee. Mine say I can close in fifteen days if they need it.

Don't go looking at houses or properties twenty percent higher than what you are pre-approved

for, it will only make you unhappy.

IF prices are too high, expand your expectations, expand the location, shrink up the square footage.

Work with lender and Realtor who are respected in the community.

We can often bridge the loan without making a contingent offer, ask how

Have your polished, sweet, smart Realtor make the offer in person

Make the offer fast and be available to answer counters quickly.

Open your emails, answer texts and phone calls promptly.

Don't fall in love with one house.

Call me (949) 784- 9699

C G

NMLS #324982

CMG Financial

1/16/2019

Down Payment Assistance

v

uyer Guide: Down Payment Assistance

Description

DOWN PAYMENT ASSISTANCE |

Down payment assistance programs help borrowers who may be unable to afford a down payment secure mortgage financing for a new home. Such programs distribute funds to qualified borrowers to cover the down payment or closing costs. There are over 2,400 homebuyer assistance programs available throughout the United States. Many prospective homebuyers may not be aware of the down payment assistance programs in their local market. As of 2015, RealtyTrac and Down Payment Resource reported that 87% of homes and condos can qualify for down payment assistance.

Programs vary on a state-to-state and county-to-county basis and provide different repayment options based on the type of loan. Down payment assistance programs are offered by state Housing Finance Agencies (HFA), cities and counties, housing authorities, nonprofit organizations, and even employers. Like other assistance programs, down payment assistance programs may have debt-to-income ratio requirements, income limits, and other variables to qualify. Down payment assistance is not limited to first-time homebuyers or borrowers with low cash reserves. Qualifications vary from market to market.

While some borrowers, such as first-time home buyers, may benefit from down payment assistance programs, other borrowers are better suited for programs like Federal Housing Administration (FHA) loans and their down payment options. Grants do not usually have to be repaid if the borrower is in the home for a designated period of time. Some down payment assistance programs require repayment, while others have repayment periods that expire.

What's stopping you from owning a home?

Introducing the Home in Five Advantage Grant

The Home in Five Advantage Grant is designed specifically for home buyers financing home anywhere in Maricopa County, including the city of Phoenix. Qualifying home buyers can receive a non-repayable down payment/closing cost assistance grant up to 3.5% of the loan amount AND never need to repay this money.

Home buyer must also qualify for a USDA, FHA, or VA loan. Contact me for a safe, 30 year fixed rate loan with NO prepayment penalty.

Up to 3.5% of Loan Amount

-2.5%-3.5% of loan amount for qualifying home buyers

-For a primary residence only

-Must occupy the home within 60 days of purchase

-Home can be anywhere in Maricopa County and Phoenix

-Minimum credit score of 640

-Maximum income of $88,340

-Maximum purchase price of $300,000

-Must attend an 8-hour home buyer education course

Subscribe to:

Comments (Atom)